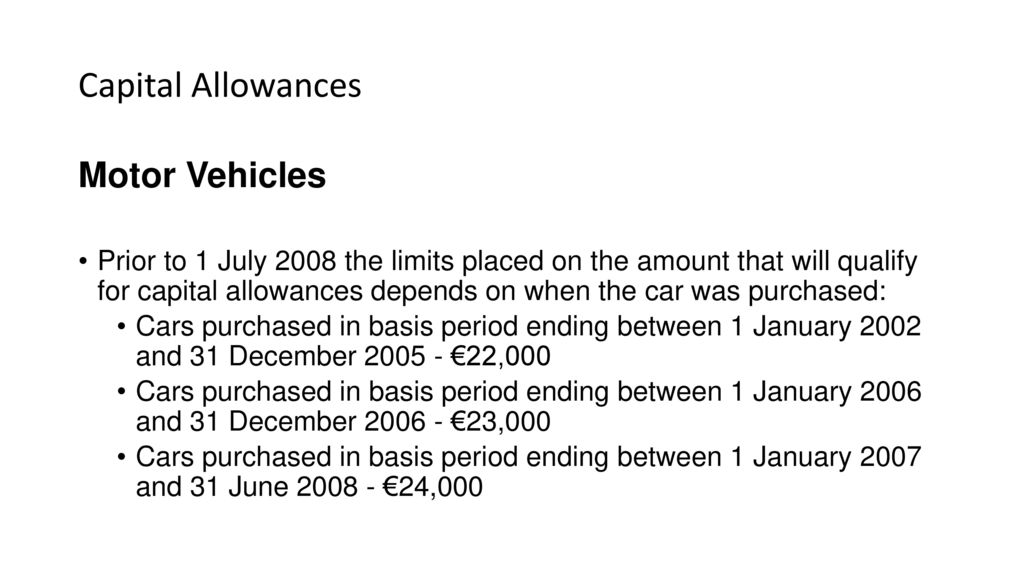

Capital Allowances for Self Employed – Motor Vehicles - Cheaper Accountant: Affordable Ltd Co Accounts from £90!

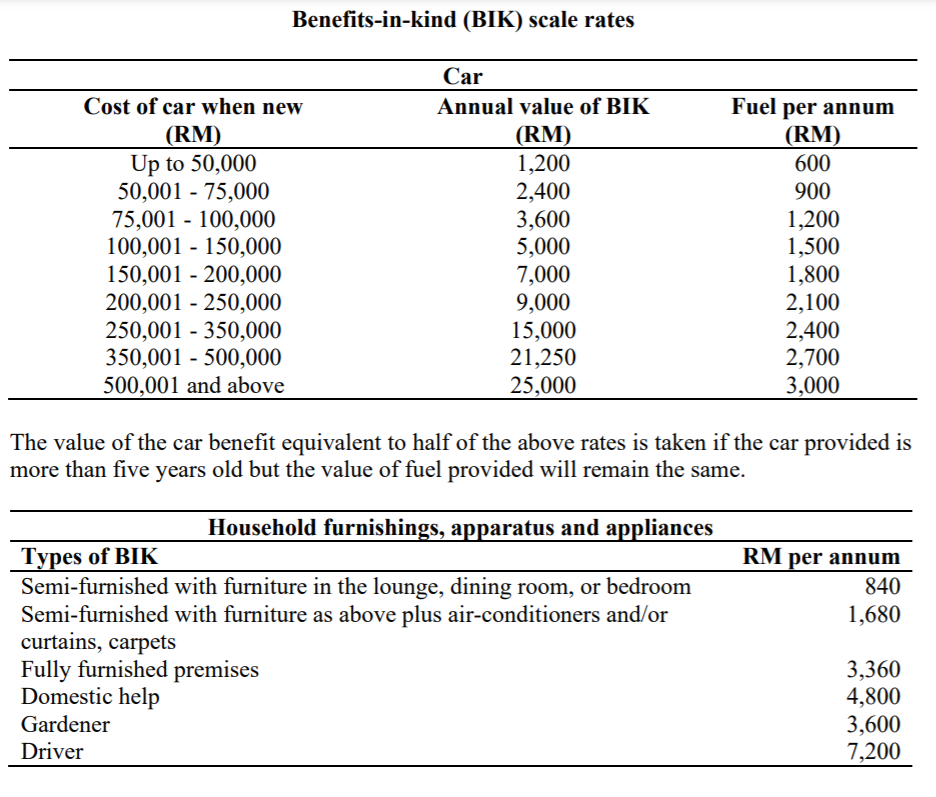

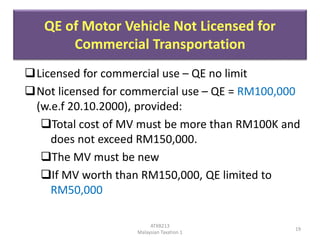

Tax implications of financial arrangements for motor vehicles When a company needs a motor vehicle, it can choose to either purc

Can I buy a Personal car under a Company and Claim Tax Deduction? - Feb 11, 2022, Johor Bahru (JB), Malaysia, Taman Molek Service | THK Management Advisory Sdn Bhd

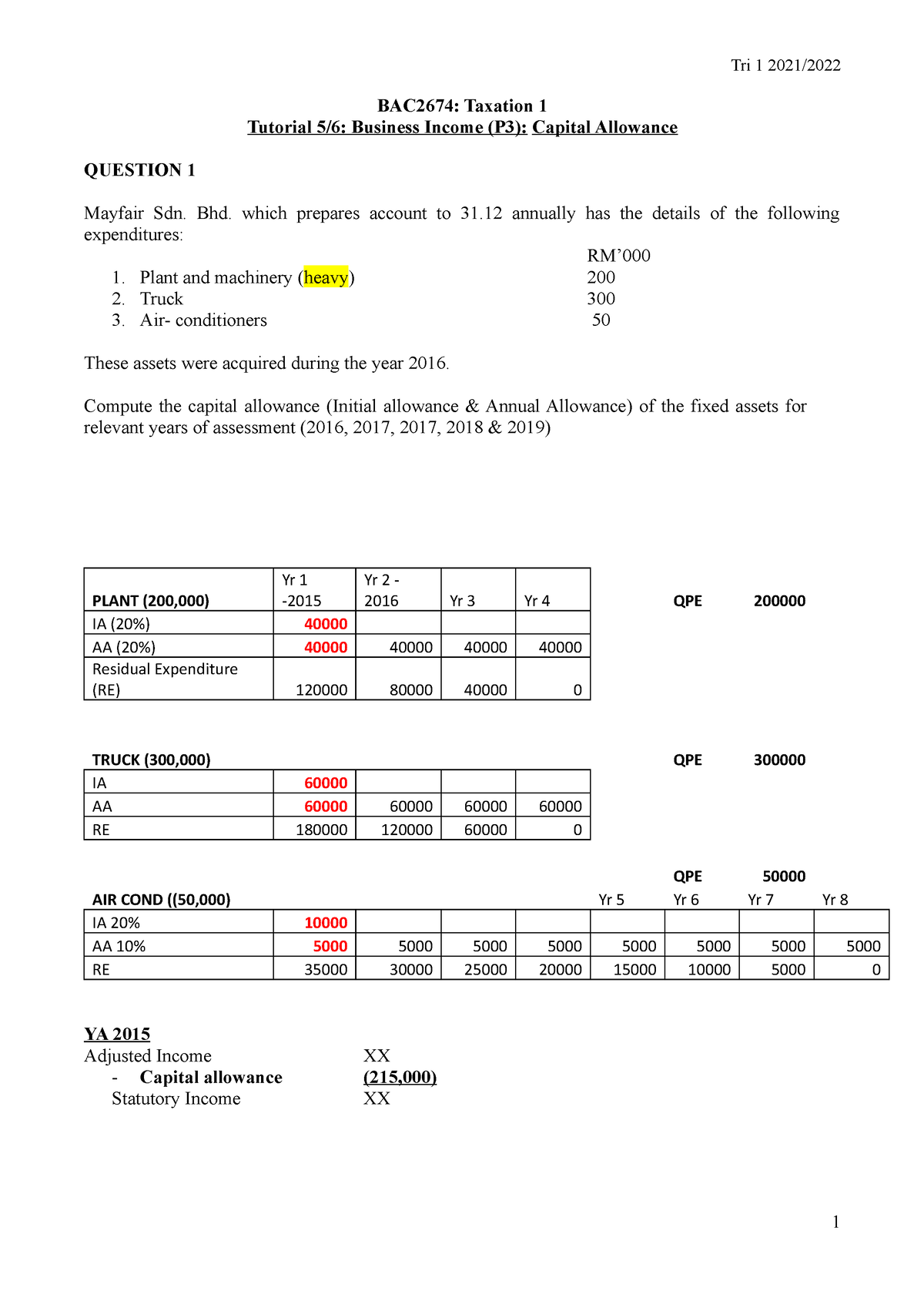

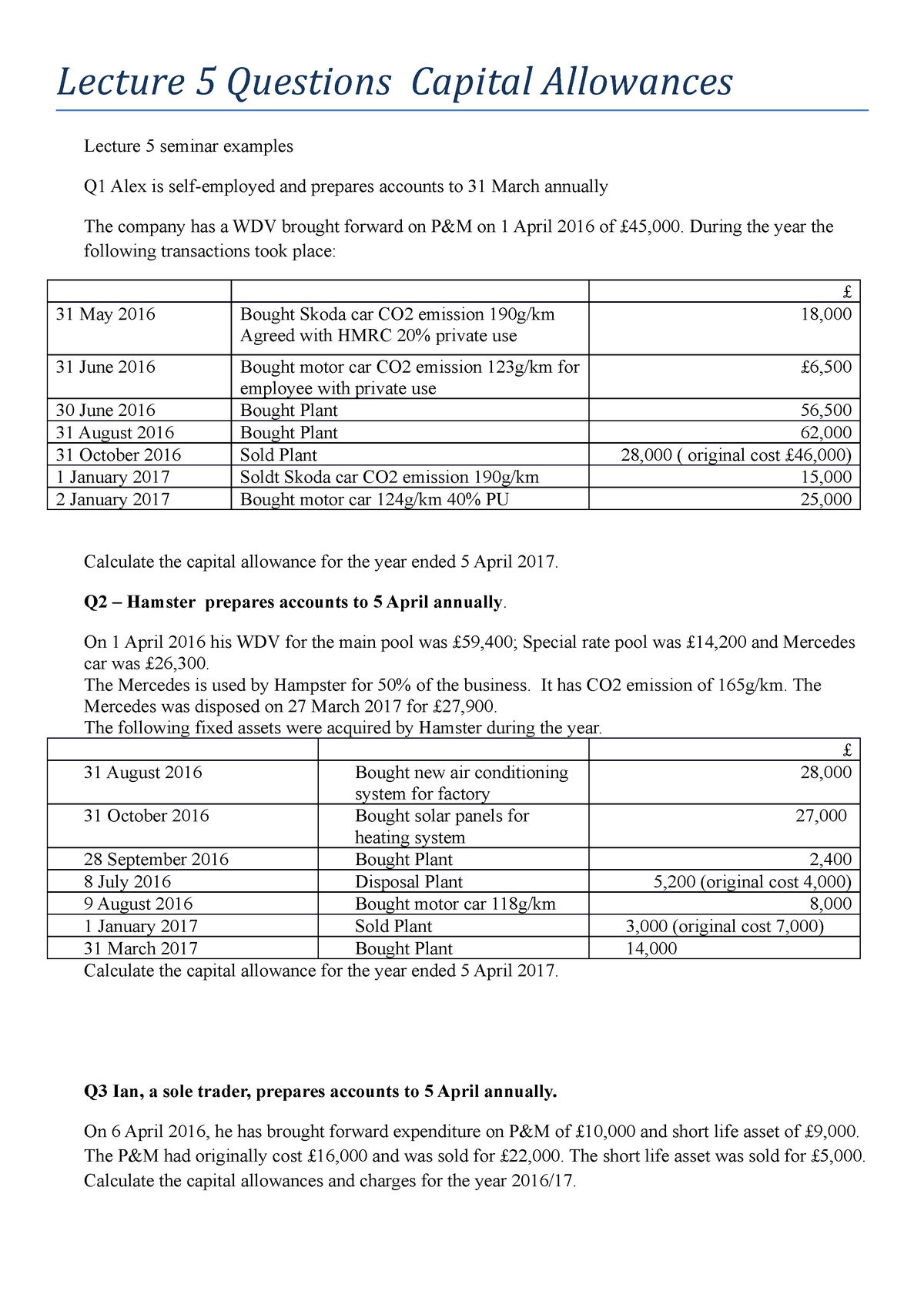

05 Capital Allowances seminar Questions 2016-17 - Lecture 5 Questions Capital Allowances Lecture 5 - Studocu

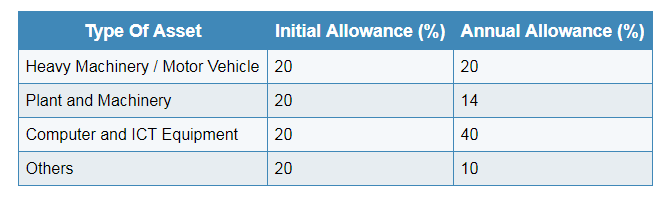

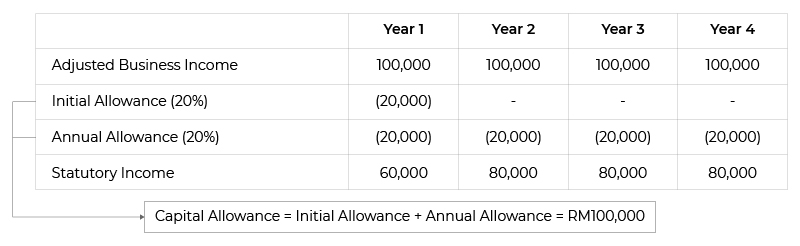

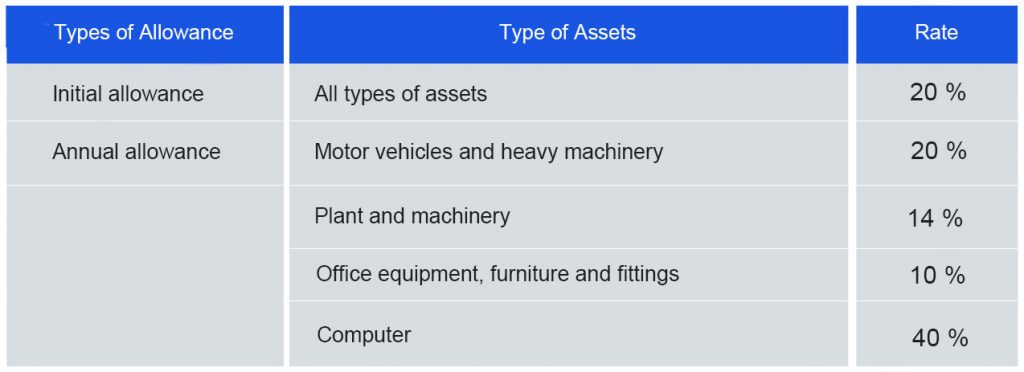

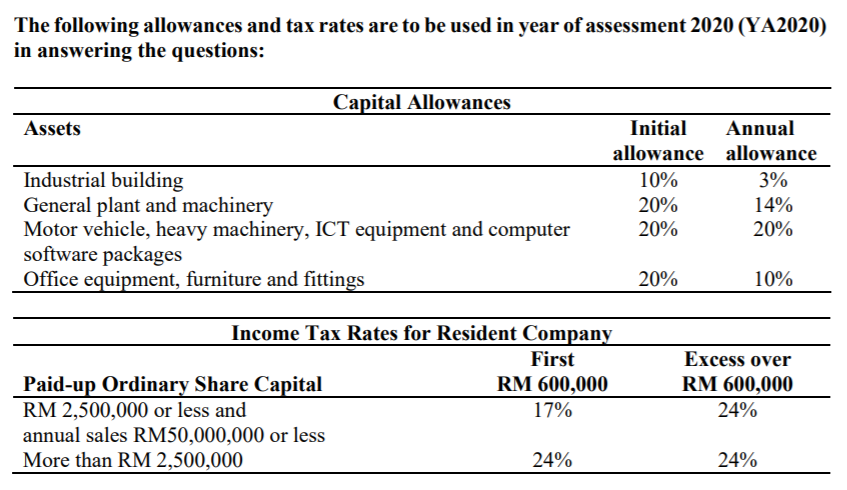

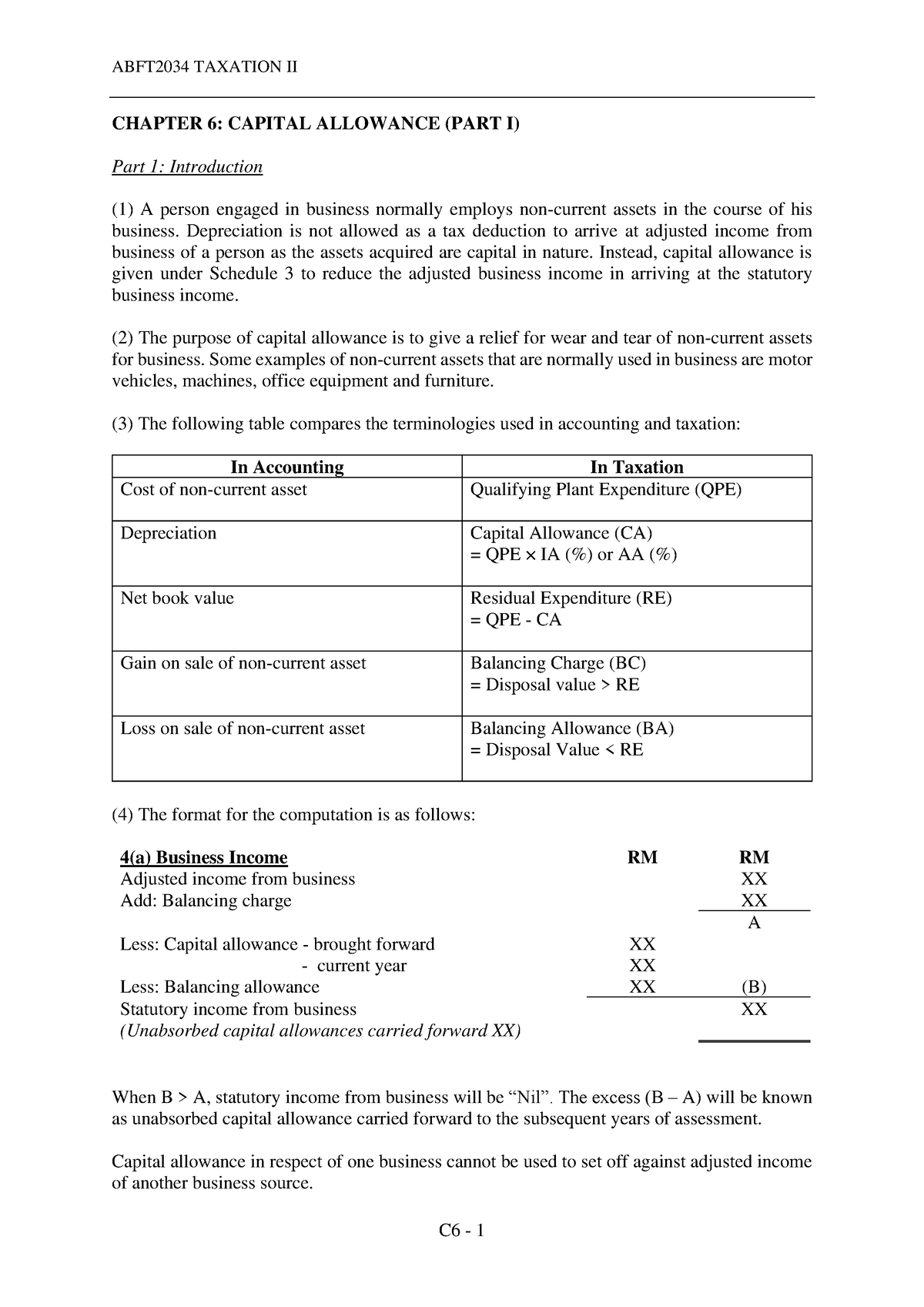

ABFT2034 Chapter 6 CA (Part I) - CHAPTER 6: CAPITAL ALLOWANCE (PART I) Part 1: Introduction (1) A - Studocu

Notes - Capital Allowance - CAPITAL ALLOWANCE Capital Allowance is a tax relief for a business who - Studocu